Investment In Bangladesh

Investment in Bangladesh - Top Investment Destination in South Asia

Bangladesh is virtually located as a bridge between the emerging markets of South Asia and fastest growing markets of South East Asia and ASEAN countries. With the proposed concept of a "Bay of Bengal Growth Triangle" with its apex Chittagong port extending south-west to Calcutta, Madras and Colombo and the south-eastern arm extends through Yangon, to Thailand, to Penang with the third arm to Colombo, this region should have growing attention of the investment world. Bangladesh has the potential to be an entry port to the region, a potential small scale Singapore, for the region covering Bangladesh, Nepal, Bhutan, eight north-east Indian states (of Assam, Meghalaya, Monipur, Imphal, Arunachal, Nagaland, Mizoram and Tripura) and resource-rich northern Myanmar, a land locked region .

Bangladesh is poised to become a regional hub where activities relating to assembling, manufacturing, trading and services, would be some of the areas that are picking up over the years. This geopolitico-economic location of Bangladesh indicates its history of being a nation of sea-farers, traders and suppliers.

The country has a policy of private sector led, liberal economic approach; export oriented, gradually transforming into assembling & manufacturing; seeking for rapid expansion of the service sector. Also looking for substantial joint venture and Direct Foreign Investment (DFI) from abroad in medium and large-scale industries and enterprises, including energy and infrastructure.

Why Investment in Bangladesh - Fast Facts

- Bangladesh has no records of defaults in its bilateral & multi-lateral donors, and debt-service liabilities.

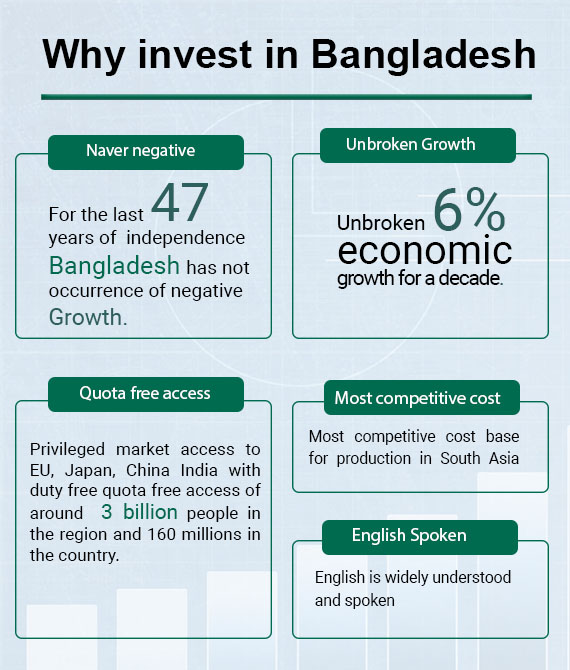

- For the last 47 years of independence, Bangladesh has not occurrence of negative growth.

- Bangladesh is the 2nd largest RMG producers and leading to become 1st within 2019

- Privileged market access to EU, Japan, China India with duty free quota free access of around 3 billion people in the region and 160 millions in the country.

- 66 among 100 private and public economic zones are underway comprising 77000 acres of fully serviced land

- Unbroken 6% economic growth for a decade

- Most competitive cost base for production in South Asia

- Cost of living is reasonable and low, and has no ethnic or communal issues

- English is widely understood and spoken

- Almost all sectors are open for investment

- No capping on amount or percentage of investment

- Repatriation of profit or equity is most hassle free

- World class One stop service is going to be in place

- Investment related services are mostly online

- Fast integrating in the global value chain

Bangladesh is a winning combination with its high connectivity, competitive market, business-friendly environment and competitive cost structure that can give you best returns. The investment policies of the Government of Bangladesh are excellent. Bangladesh has already created one of the most attractive and liberal investment regimes in the region.

Over the last several years, Bangladesh consistently recorded progress on various socio-economic indicators, including GDP growth, per capita income, food production, low inflation, job creation, social mobility and women’s empowerment.

Effective macroeconomic plans, along with the implementation of the sixth and seventh five-year plans, have helped Bangladesh avert the impact of the global economic downturn and sustain the economic growth.

Bangladesh offers a well-educated, highly adaptive and industrious workforce with the lowest wages and salaries in the region. About 57.3% of the population is under 25, providing a youthful group for recruitment. The country has consistently developed a skilled workforce catering to your needs. English is widely spoken, making communication easy.

Bangladesh is strategically located in between India, China and ASEAN markets. As the South Asian Free Trade Area (SAFTA) comes into force, investors in Bangladesh enjoy duty-free access to India along with EU, Japan and major developed countries.

Public Private Partnership in infrastructure investment offers a new window of opportunity for investors while the Existing Export Processing Zones and Special Economic Zones are being expanded and developed for competitive manufacturing in local and global markets.

Bangladesh has proved to be an attractive investment location with its 160 million populations and consistent economic growth for a decade leading to strong and growing domestic demand.

Energy prices in Bangladesh are the most competitive in the region.

Bangladesh enjoys tariff-free access to the European Union, Canada and Japan. In EU, Bangladesh enjoys 60% of RMG market share and is the top manufacturing exporter amongst 50 LDC countries.

Bangladesh offers the most liberal FDI regime in South Asia, allowing 100% foreign equity with unrestricted exit policy, remittance of royalty and repatriation of profits and income.

Bangladesh Becoming major player in pharmaceutical sector with 20% growth and exporting to 100 countries and exemption of patent requirements till 2032. An API (Active pharmaceutical industry) industry is underway

Bangladesh offers export oriented industrial enclaves with infrastructure facilities and logistic support for investors through Economic Zones and Export Processing Zones. The Country is also developing its core infrastructures like roads, highways, surface transport and port facilities for a better business environment.

Bangladesh has shown tremendous resilience in fighting natural calamities like floods and other droughts. Itis often known as the land of natural calamities. The way it got back to its feet every time it was challenged is something that speaks volumes about the spirit and zeal of the nation.

Bangladesh has become one of world’s most remarkable and unexpected success stories in recent years. There is no doubt Bangladesh will become a middle-income country by 2021. The country aim to become a developed one by 2041. Businesses around the world do not like to miss the growth opportunities and hence some of them are already stepping up their investments in Bangladesh and rest eying Bangladesh for investments in coming years.